Fintech is a portmanteau of finance and technology. In simple words, fintech is a made-up terminology for new-age finance management using the internet. The rise of technology has opened new avenues for businesses to enter the financial landscape and offer multiple services. Apart from traditional banking activities, fintech applications provide Payment, Insurance, Recharges, Trading, etc.

The geographical differences affect the nature and usage of mobile applications drastically. The American user prefers separate applications for banking, recharge, investment, or trading while Chinese users rely on a single application to cover all the activities. Fintech applications are developed and evolved differently as a result of these differences.

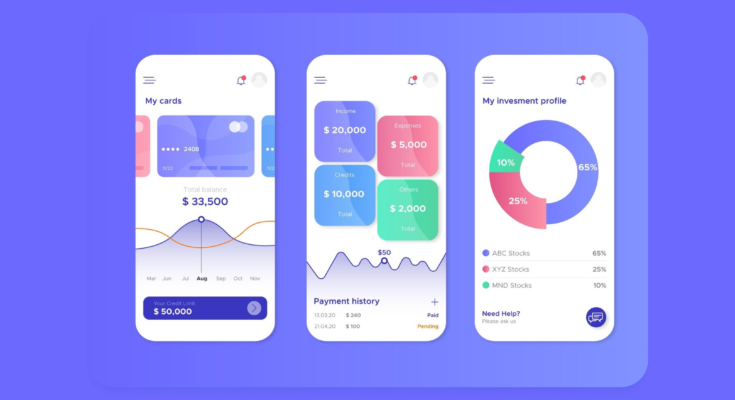

Types of Fintech Applications

There are various types of fintech applications available in the market. These applications serve different purposes and cater to different audiences, below the given list explores the types of applications in detail.

Investment – Investment applications help to buy financial instruments such as Stocks, Mutual Funds, Fixed Deposits, etc.

Payment – Payment applications help to transfer peer-to-peer money.

Lending – Lending applications provide loans for different purposes, these loan providers can be Non-banking financial operators.

Insurance – Insurance applications help to buy different types of insurance such as health insurance, and life insurance.

Financial Management – Financial management applications help individuals manage finances.

Crypto – Crypto applications help to trade in Cryptocurrencies such as Bitcoin and Ethereum.

Neo Bank – Neo Banks function as traditional banks but they do not have any physical branch.

Crowdfunding – Crowdfunding apps enable the transaction between fundraiser and crowd.

Tech Stack

Multiple technologies can be used to create a mobile application. These technologies can be classified into three different categories. Native, Hybrid, and Progressive.

Native:

A native application is an application that is developed for one particular mobile operating system. There are two major OS available in the market Apple’s iOS and Google’s Android. When an application is developed for one particular platform in its native language, it is known as a Native application. For iOS Swift is used as a primary language and for Google Play Store Kotlin and Java are used for primary development. All the major consumer applications in the market are developed using this method.

Hybrid:

Hybrid applications, also known as cross-border applications offer a popular method of creating one application that can be used for both Android and iOS. Flutter is a popular development kit that offers the facility to create applications in one go. These types of applications are good for small user-based applications with limited facilities. Since the incorporation of functionality is limited one has to switch to the native language for a higher degree of modification.

Progressive:

Progressive mobile applications are built upon the technologies that are used for a website. These applications can have the huge benefit of being able to incorporate plugins. These apps are also easier to update with time as the changes in the website can be incorporated into the mobile application easily.

Cost of Creating a Fintech App

The cost to develop a fintech app varies depending upon the type of application that is being created. Multiple factors play a part in this such as the platform, tech stack, application type, complexity, and functionality.

The average cost to develop fintech app using native technology is as below

| Investment | $25,000 to $2,00,000 |

| Payment | $30,000 to $2,50,000 |

| Lending | $20,000 to $1,50,000 |

| Insurance | $35,000 to $2,00,000 |

| Financial Management | $15,000 to $1,00,000 |

| Crypto | $40,000 to $1,50,000 |

| NeoBank | $25,000 to $1,50,000 |

| Crowdfunding | $20,000 to $40,000 |

Factors that Influence the Cost

Technology:

The major factor that defines the cost of development for a mobile app is the technology that is being used for the development. Native apps tend to be higher compared to hybrid and progressive apps. While in the native, Android applications are expensive to develop due to their complexity and availability of a wide range of Android versions.

Functionality:

Functionality is the complexity that needs to be developed in the application. The more functionality is developed, the more complex the application development becomes. The higher number of functionality also increases the required development time, leading to increasing costs.

UI/UX:

Choosing the right UI/UX (User Interface -User Experience) is important. Typically this process requires time, if done in a hurry and in the wrong way, the user experience might be hampered which eventually leads to a smaller number of active users.

Integrations

Integration of API (Application Programming Interface) is a time-consuming process. The more APIs you try to incorporate the more costly and time-consuming application it becomes. However, APIs help to make applications smooth and offer multiple functionality in one place.

Development Location

If the development location is a developed country then there are higher chances of the application becoming more expensive. Since the salary of developers tends to be multifold in developed countries. If the development is conducted in a developing country then a lot of money can be saved on the development.

Conclusion

Creating a fintech application is a rewarding process if the right pathway is followed. The market of fintech is growing at an exponential rate, and finding a niche can help ensure the success of new applications in the market.

FAQs

- What is fintech mobile app?

A fintech mobile application is an application that deals with finance using technology. There are multiple types of fintech applications available in the market today.

- How does fintech app work?

The functionality of a fintech app depends upon the type of application. Most fintech applications deal with streamlining transactions and increasing investment.

- What are the best fintech apps?

Robinhood, Chime, Revoult, Binance, and Coinbase are some of the best fintech apps available in the market today.

- How safe is fintech?

Fintech apps are relatively safe but not as safe as traditional banks. Since the nature of fintech apps differ it is important to read all the terms and conditions before conducting transactions using a fintech application.

- Who uses fintech?

Banks, small businesses, large businesses, and the general public all use fintech applications nowadays.